Become PCI DSS Compliant with Payment Vault

Expand your business into new markets and stay PCI compliant

Data compliance with the InCountry Payment Vault

Features

- Compliant with the PCI DSS global industry standard

- Meets local requirements for payment data storage in country of origin

- Seamless integration into your product or service sales pipelines

- Versatile security of payment card data

Benefits

- Eliminate borders for business expansion

- Minimize investments into PCI compliance

- No changes to your infrastructure or business operation

- Secure customer data against any potential threats

- Reduce local compliance risk

How it Works

Frequently asked questions

Currently, Payment Vault only supports Stripe, but we are working hard to expand the list of supported payment providers. Please let us know what payment provider and countries you need by dropping an email to us.

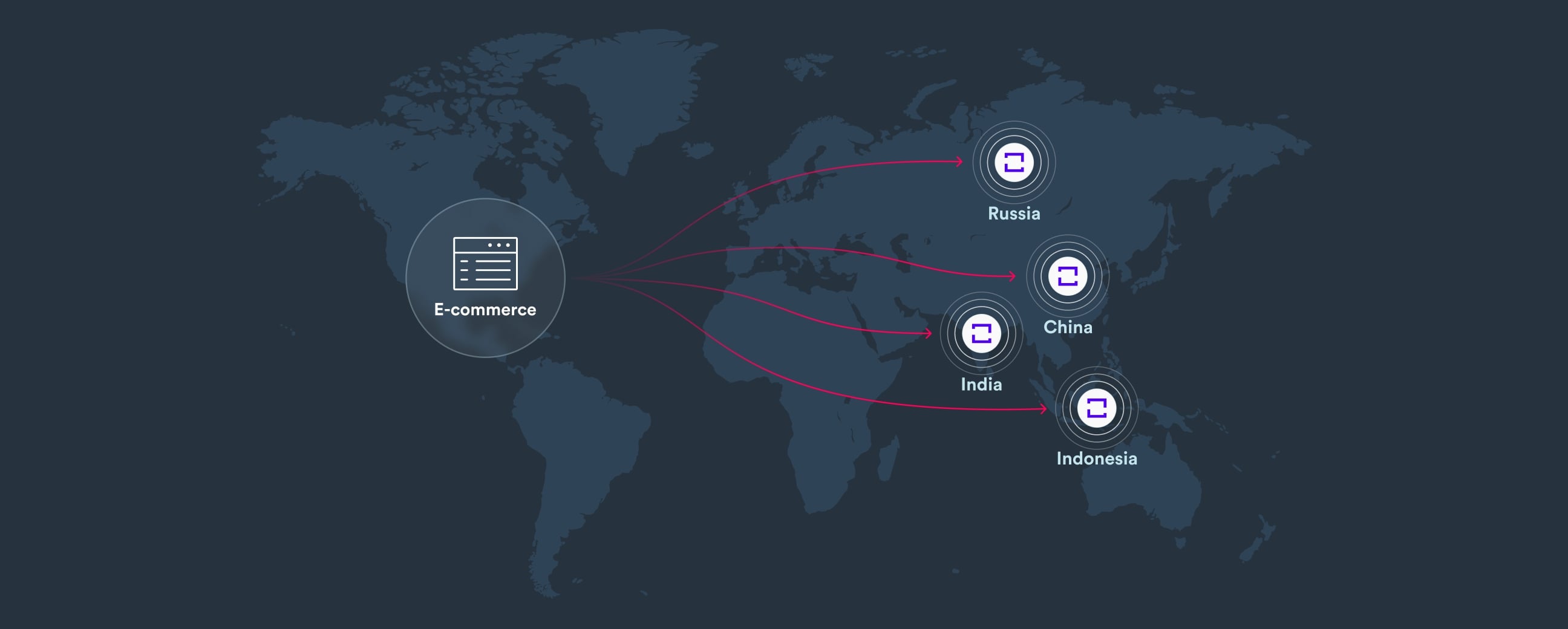

Some local regulations require the financial information of the country’s citizens to stay within the country of origin. Such requirements already exist in China, Russia, India, and Indonesia, and the list is sure to expand in the future, as several countries have corresponding legislation pending.

Payment Vault encrypts the string containing the cardholder’s name, card number, and expiry date with the AES-256 algorithm. This encrypted data is further stored on the InCountry platform in the country of origin.

Tokenization is applied to the payment card data to preserve the capability to save the customer’s payment card data in your database. This tokenized data can be further used to identify the required payment card when performing recurring payments.

No, CVC/CVV codes are not stored on the InCountry platform.

In general, you just need to create a Payment Vault integration and call our payment form when your customers initiate a payment transaction.

Yes, yes, and yes. Payment Vault has proven itself to be PCI DSS compliant time and time again.